Getting The Electronic Financing To Work

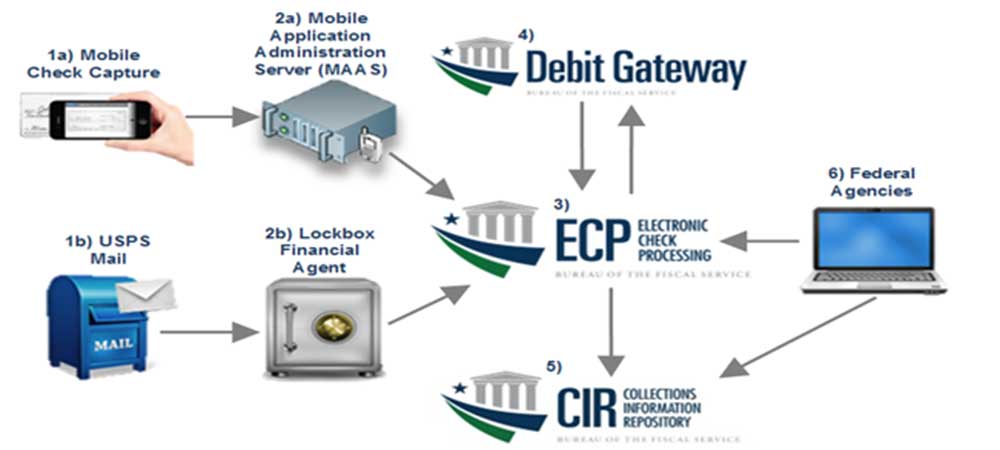

An example of a little system is an atm machine network, a collection of interconnected computerized teller devices that are linked to a centralized banks and also its computer system. An instance of a huge web banking system is the Federal Reserve Wire Network, called Fedwire. This system allows individuals to take care of large, time-sensitive payments, such as those required to settle property transactions.

In the 1950s the Bank of America was one of the first institutions to develop the suggestion that digital computer systems might take control of the banking tasks of taking care of checks and stabilizing accounts, which was, back then, very labor-intensive. Various other organizations gradually joined the initiative as well as advanced away from using paper checks and towards all-electronic banking.

Digital banking permits customers of most financial institutions to do their banking at any kind of hour of the day, no matter of the bank's operating hrs (electronic financing). If consumers choose to do such points as transfer funds or pay bills, they can generally do so from anywhere Net gain access to is available.

Electronic Financing - Truths

As online banking has actually come to be extra sophisticated, financial institutions have actually been formed that operate solely as electronic banks as well as have no physical store front for customers to use. Without the expenses of investing in and also keeping physical "bricks-and-mortar" frameworks like conventional banks do, on the internet financial institutions have the ability to supply greater rate of interest on interest-bearing accounts (passion payments are fees that customers accumulate for maintaining their cash in the financial institution).

Much of these customers have their company instantly transfer their incomes right into their savings account online (an approach called straight down payment, which is additionally really generally made use of by customers of typical financial institutions). Some companies, nevertheless, do not use straight down payment. If a client of an on the internet bank receives a paper check, she or he can not stroll right into their financial institution as well as cash it.

Some customers watch this aggravation as a downside of utilizing an online bank.

Indicators on Electronic Financing You Need To Know

If you're seeking to increase your debt score, you may have considered cell phone financing. This write-up will discuss just how financing a mobile phone jobs, and also if financing one can aid you build credit rating. You can fund a cellular phone and pay it off gradually. There are a couple of different methods to fund a cellular phone.

You can likewise finance through a 3rd event, such as an electronic devices store. These retailers supply bank card that commonly have interest-free durations. Financing a cell phone can influence your debt in three various methods: If you're funding with a phone manufacturer or 3rd party, they might place a tough inquiry, additionally known as a difficult credit history check, on your credit rating record.

Electronic Financing Can Be Fun For Everyone

If your lender reports the account to the credit scores bureaus (like when you buy via a significant manufacturer), you can develop a favorable credit scores background click for source by making your settlements on time. Additionally, you can injure your rating by missing payments. If you fall back on repayments, your account might get closed or sent out to collections.

If you have a spotless settlement background with your phone costs and can add it to your credit score record, you might be able to improve your score. While financing through your cordless service provider won't help you build credit, there are other methods to go about it. You might additionally purchase the phone with a credit card on your very own settlement timetable.

Not known Details About Electronic Financing

The total value of these payments was close to $73 trillion.

Citizens' flexible platform allowed us to launch at six major U.S. retailers in one year. We couldn't have done that with any kind of various other lending institution. Supervisor of e, Business I have actually done a few of these executions. Possibly way too many. This was conveniently one of the most arranged and also mistake cost-free. Could not be extra pleased and also ecstatic to companion with Citizens.

Digital money (e-money) is broadly specified as an electronic store of financial worth on a technological device that might be commonly used for making payments to entities various other than the e-money company. The device works as a pre-paid bearer tool which does not necessarily involve checking account in purchases. E-money products can be hardware-based or software-based, depending on the modern technology utilized to save the financial value.

Little Known Questions About Electronic Financing.

Monetary values are typically moved by methods of device visitors that do not require real-time network connectivity to a remote web server. Software-based items employ specialized software application that operates on usual individual devices such as desktop computers or tablets. To allow the transfer of financial values, the personal gadget generally requires to establish an on the internet link with a remote web server that regulates making use of the buying power.

For check over here small business owners, the bottom line is always top of mind. And one way to maintain cash moving in is to approve the payment types that are convenient for both companies and their clients.

The greatest distinction is that e, Examine usages ACH to move funds rather than the card networks, so refining charges are lower. There are no bank card interchange costs for e, Examine approval, and directory also fees can be as low as 10 cents per transaction. This can make a big difference to organizations that approve huge or recurring settlements.

Facts About Electronic Financing Uncovered

EFT stands for digital funds transfer. It's an overarching term that covers a number of kinds of electronic repayments including e, Check, ACH transfer, cable transfer, Pay, Pal settlements, direct down payment, SEPA repayments, neighborhood bank transfers and also e, Pocketbooks. Essentially, purchases like e, Checks as well as ACH are kinds of EFT, but not all EFT purchases are e, Checks and ACH.

Unlike ACH transfers, which take area in batches, cord transfers happen manually, one purchase at a time. In order to approve e, Check repayments, a service has to first obtain the client's details including their financial institution routing as well as inspecting account numbers.

Comments on “Electronic Financing Fundamentals Explained”